What is the Forward Charge Mechanism under GST With Example?

- 8 Oct 25

- 8 mins

What is the Forward Charge Mechanism under GST With Example?

Key Takeaways

- The Forward Charge Mechanism (FCM) under GST makes suppliers responsible for collecting and remitting GST to the government.

- FCM applies to regular taxpayers, casual taxpayers, non-resident taxable persons, and businesses under the GST composition scheme.

- With FCM, every GST invoice shows a clear tax breakdown, ensuring transparency in tax payment for buyers.

- Forward Charge Mechanism simplifies compliance, reduces tax evasion, and ensures efficient GST collection for the government.

- Suppliers under FCM can claim Input Tax Credit (ITC) on their business purchases, reducing overall tax liability.

Before the introduction of GST (Goods and Services Tax) in India, there were a number of indirect taxes that were hard to calculate, and the collection of tax process was haphazard. However, GST acts as a replacement for many indirect taxes such as VAT, sales tax and service tax.

However, the implementation of the forward charge mechanism under GST relieved the government of the hefty responsibility of collecting tax from every taxpayer and making suppliers collect and remit the taxes.

This was just an introduction. Further in this article, we are going to understand more about the forward change mechanism under GST, including its advantages and collection process.

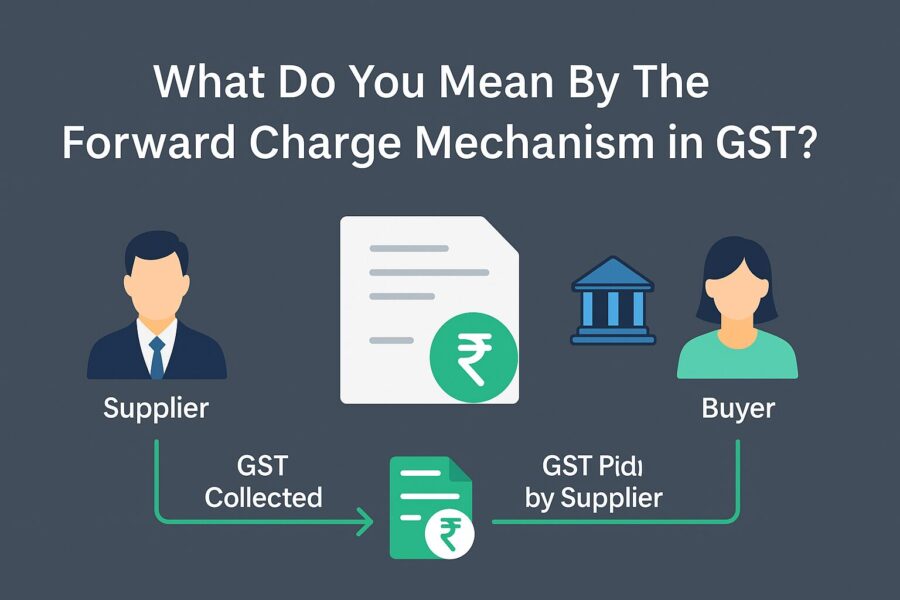

What Do You Mean By The Forward Charge Mechanism in GST?

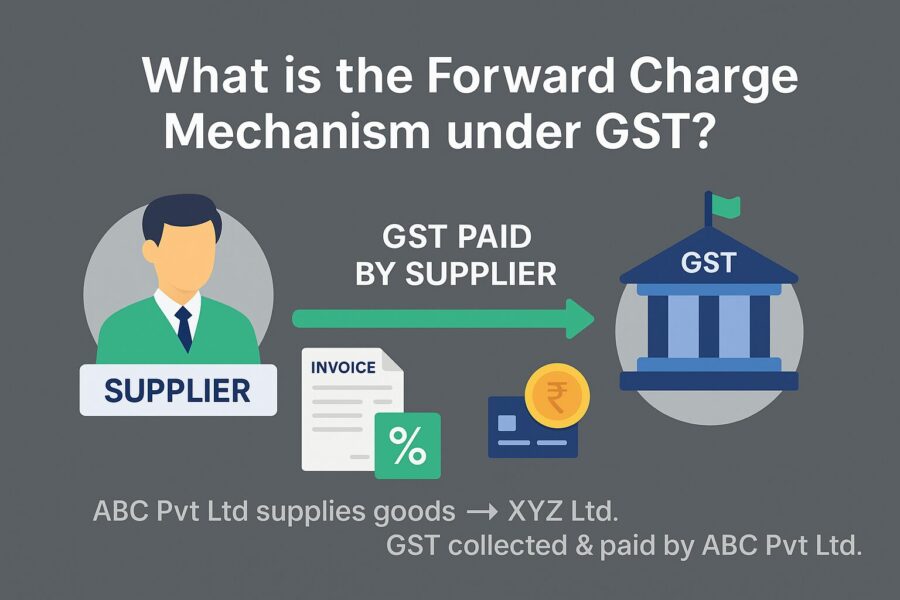

FCM, or Forward Charge Mechanism under GST, is a new tax collection technique where suppliers of goods and services are responsible for collecting and remitting taxes to the government.

Since taxpayers pay their GST while buying the product from suppliers, they are free from the hefty burden of paying those taxes directly at once. This relieves them from keeping records of their purchases and helps general taxpayers stay compliant with GST regulations and due dates.

Additionally, it also simplifies direct tax compliance for businesses by ensuring that all taxes related to a transaction are handled in a single step.

Applicability of Forward Charge Mechanism in Various Scenarios Under GST

Not all suppliers of goods and services are eligible to collect taxes under the FCM mechanism. The applicability in various scenarios includes regular taxable persons, casual taxpayers and non-resident taxable persons and people under the GST composition scheme.

Suppose person A organises a one-day event in a banquet hall, then they come under casual taxpayers, and they need to incorporate the FCM mechanism to pay taxes related to the event. Moreover, a normal businessperson who chooses a GST composition scheme has to follow the Forward Charge Mechanism under GST to make tax compliance easier for taxpayers and tax collection easier for the Government.

This is particularly important for small businesses, as it helps reduce the complexity and compliance costs associated with multi-layered tax filings.

Benefits of the Forward Charge Mechanism

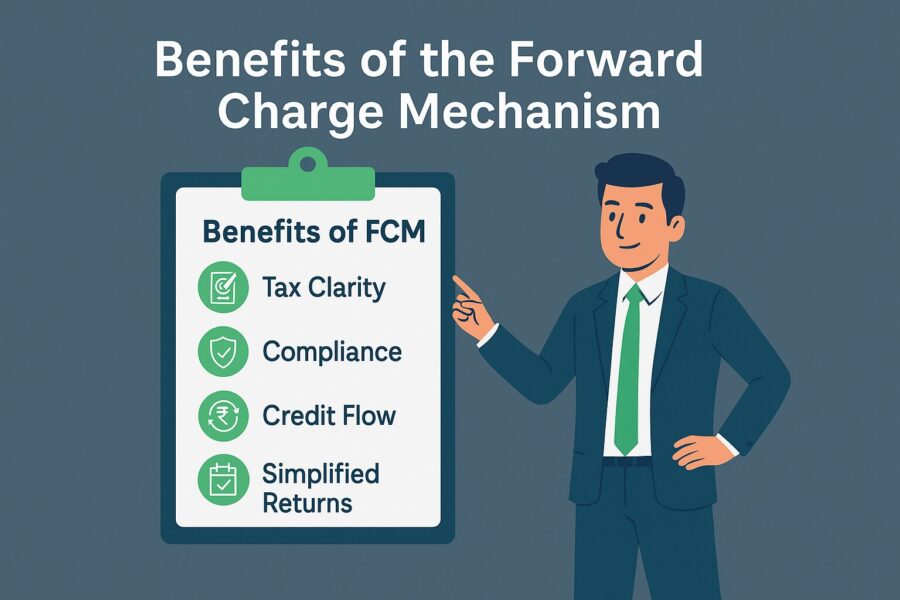

The Forward Charge mechanism under GST is a big change in our tax collection process, which is beneficial for taxpayers and the Government both. Even suppliers can have a thorough knowledge of their books, with this mechanism helping them with their business. Following are some key benefits of the FCM mechanism:

- Transparency in Tax Payment

Whenever you pay a bill in a GST-registered business, you will receive an e-invoice consisting of their GSTIN and other crucial details. Along with that, you can clearly see the amount of GST you are paying. This invoice breakdown helps taxpayers calculate how much they are paying and in what percentage.

- Streamlined Taxation Process

The Forward Charge Mechanism under GST makes you pay taxes as soon as you buy things from a supplier and provides you with detailed supplier invoices. Going through these invoices can help you easily understand your tax calculation and know your GST obligations in a better way.

- Encourages Following GST Rules and Regulations

The Forward Charge Mechanism makes it the responsibility of the supplier for tax payment within the due date after collection. This reduces the chance of tax evasion as they will be answerable for the missing amount. This will reduce the probability of non-payment of taxes and encourage all suppliers to abide by tax laws.

- Efficiency in the Tax Collection Process

FCM is a great tax revenue collection mechanism. This process makes suppliers responsible for tax collection of their own supplies and making them pay back to the government within the due date. This is one of their tax obligations, making them duly collect their taxes.

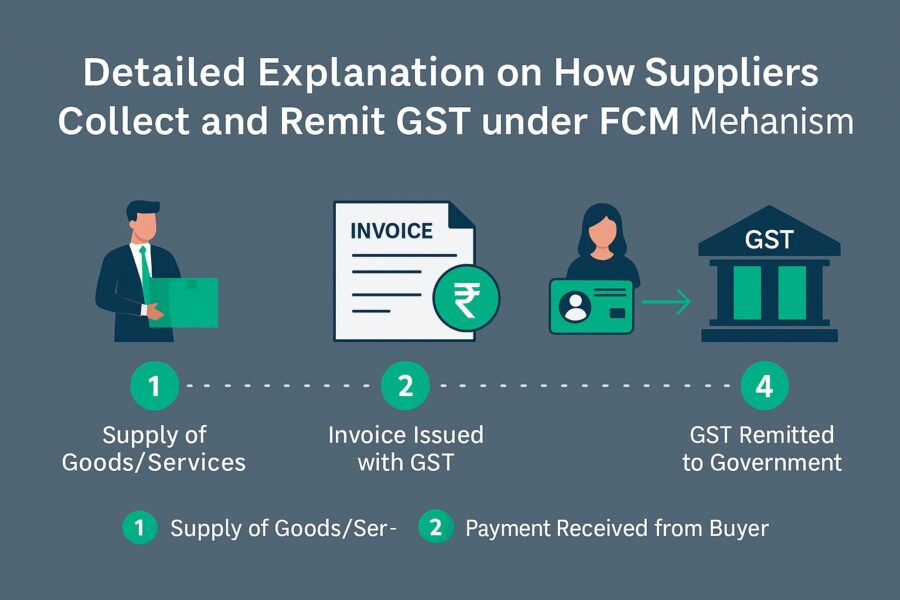

Detailed Explanation on How Suppliers Collect and Remit GST under FCM Mechanism

Now, since you know what is Forward Charge Mechanism under GST. You must be wondering how exactly suppliers collect and remit taxes to the government and why people trust them with their taxes. Here are the answers to all your questions.

Generation of GST Invoice by Supplier

When a taxpayer purchases goods or services from a supplier, that supplier provides a GST invoice clearly stating the amount of GST they are paying. The invoice breakdown includes itemized details such as the value of goods, GST amount, and supplier’s GSTIN.

Payment of Final Amount

The e-invoice contains information like the supplier’s GSTIN number and other details. You can verify their legitimacy on your phone. Once verified, you must pay the supplier their deserved amount which includes cost of goods and applicable taxes.

Total Tax Collection and GST Return Filing by Suppliers

Suppliers collect tax from taxpayers on a regular basis whenever they make sales on taxable items. However, to remit these collected taxes, they disclose their collected taxes and remit them to our government by filing GST return filings whenever required. This also reduces compliance costs in the long term by promoting digital filing and centralised documentation.

Collection of Input Tax Credits for GST Registered Entities

GST-registered entities get an opportunity to collect Input Tax Credits. This is the money they receive for paying taxes on items they purchase for business purposes. They can claim it when they file their own tax returns filings. Claiming the Input Tax Credit on GST helps to reduce their personal tax burden to some extent.

Conclusion

The Forward Charge Mechanism under GST is a great GST collection technique. It develops transparency between the government, suppliers and the taxpayers. This mechanism of tax collection makes the suppliers themselves responsible for collecting their taxes and holding them responsible for paying their taxes. This reduces the likelihood of tax evasion.

Forward Charge Mechanism under GST helps the Government collect more revenue and encourages taxpayers to develop a clearer business environment. Hence, both suppliers and small businesses benefit from it. Moreover, suppliers can also reward themselves for their service of tax collection by claiming Input Tax Credits on their purchases.

💡If you want to streamline your payment and make GST payments via credit, debit card or UPI, consider using the PICE App. Explore the PICE App today and take your business to new heights.

FAQs

What is Forward Charge Mechanism (FCM) under GST?

Who is liable to pay tax under the Forward Charge Mechanism?

What are the benefits of the Forward Charge Mechanism in GST?

Ensures transparency by showing GST breakdown in invoices.

Simplifies compliance since buyers don’t need to file separate GST payments.

Reduces chances of tax evasion as suppliers are accountable.

Improves efficiency in GST collection for the government.

Allows businesses to focus on trade while staying compliant.